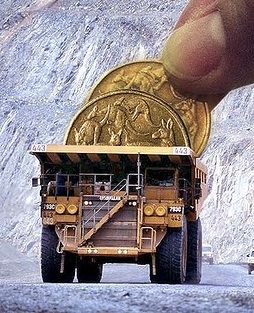

Tax moves to mine less from resources

The Minerals Resource Rent Tax (mining tax) will stay in place after the Federal Government rejected amendments put forward last week.

The Minerals Resource Rent Tax (mining tax) will stay in place after the Federal Government rejected amendments put forward last week.

Senators said they would not allow the repeal of the profit tax on mining companies unless the Government maintained the programs it funds.

The Government says the tax is too narrow, but wants to scrap it instead of widening its revenue base.

Fewer than 20 big taxpaying companies contributed to the meagre revenue, drumming up just $300 million of an expected $12 billion in the first two years.

It appears that at least 125 other mining companies are complying with the mining tax legislation, while not actually paying any tax due to concessions and exemptions.

But Finance Minister Mathias Cormann says the benefits from the tax were already doomed, as it was not raising the capital required.

“The former Labor Government locked in over $17 billion of expenditure over the current forward estimates... against the non-existent proceeds of this failed tax,” he said in a statement.

“The Government cannot afford to keep borrowing money to pay for this kind of unfunded spending.”

The Association of Mining and Exploration Companies (AMEC) says that “combined with the removal of the carbon tax, the repeal of the MRRT will go a long way to restoring confidence and critical investment back into the mining industry”, according to CEO Simon Bennison.

Print

Print